As the US national debt passes $33 trillion and a government shutdown looms, Wall Street feels defensive.

That shutdown could sour sentiment and deal a blow to an economy already dealing with high gas prices, autoworker strikes and elevated inflation — with some saying it could even increase the possibility of a recession.

Fitch sent Congress a wakeup call after the debt limit fight earlier this summer. The ratings agency downgraded US sovereign debt from AAA to AA+ in August, citing the nation’s mounting debt and partisan brinkmanship as the major reasons behind its decision.

But the government hit snooze.

What’s happening: The gross national debt has grown at an alarming pace since then — by $1 trillion in the last three months alone.

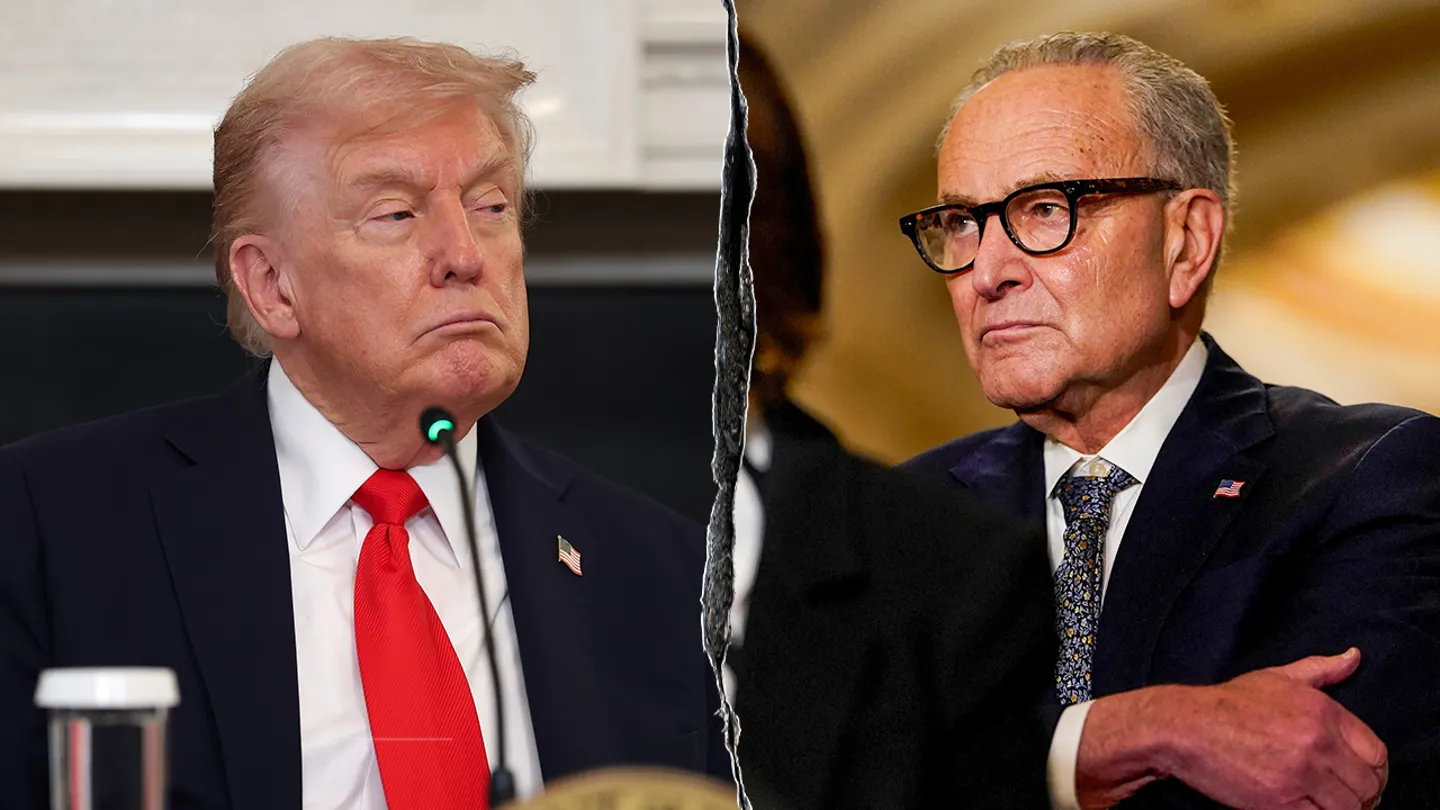

Political finger pointing around what caused the accelerated debt accrual, meanwhile, has left the government at an impasse around the budget.

The budget deficit — the difference between what the government spends and what it takes in — reached $1.5 trillion for the first 11 months of the fiscal year, an increase of 61% since last year.

The recent increase in interest rates has already made it much more expensive for the government to pay back what it owes. And a shuttered government, without a plan for how to pay down its debt, would make the problem worse.

“As we have seen with recent growth in inflation and interest rates, the cost of debt can mount suddenly and rapidly,” said Michael Peterson, CEO of the Peter G. Peterson foundation, a bipartisan group that advocates for fiscal responsibility. “With more than $10 trillion of interest costs over the next decade, this compounding fiscal cycle will only continue to do damage to our kids and grandkids,” he said.

Republicans say federal spending programs championed by the Biden administration are too expensive, and Democrats say GOP-backed tax cuts have squashed revenue.

September 30 marks the end of the fiscal year, and lawmakers will have to finalize a 2024 budget deal by October 1 to avoid a government shutdown. But not one of the 12 appropriation bills required to fund the government has passed through Congress yet, making it unlikely that a plan will be passed by the deadline.

The threat of a shutdown comes as the US economy is already feeling the pressure of inflation, interest rate hikes and a high deficit, UAW strikes, renewed student debt payments and rising gas prices, said Gary Schlossberg and Jennifer Timmerman at the Wells Fargo Investment Institute.

Each of those things, they said “weighs on housing, consumer finances and government financing expenses in adding to recession risks during the closing months of the year.”

Why it matters: A government shutdown would stop most government agency activities and services and require all non-essential government personnel to take unpaid leave. Analysts at EY estimate that there are about 800,000 non-emergency federal workers with an average salary of $95,000 each.

The extent of the damage comes down to how long a potential shutdown lasts.

Each week of a government shutdown, estimated Gregory Daco, EY chief economist, and his team, would cost the US economy $6 billion and shave GDP growth by 0.1 percentage points in the fourth quarter of 2023.

The shutdown would also lead to a delay in economic data, said Daco, “creating a potential headache for economists and policymakers trying to assess the economy’s health.”

Shutdowns over the past 30 years have lasted between a few days and over a month, but Schlossberg and Timmerman believe that given the “hardened positions in an increasingly polarized Congress,” this one has the potential to last a few weeks.

The event, they say, could be “yet another catalyst that could spark increased volatility and extended weakness in stocks, given the underlying vulnerabilities we see in the broader economy.” Investors should prepare a defensive portfolio, they added, “positioning for an economy approaching an anticipated recession.”

What to expect from Wednesday’s Fed decision

The Federal Reserve is expected to hold its benchmark lending rate steady on Wednesday as it waits for more data to understand how previous rate hikes are affecting the US economy, reports my colleague Bryan Mena.

The central bank raised rates to a 22-year high in July.

At the conclusion of its two-day policy meeting on Wednesday, the Fed is also set to release a fresh set of economic projections that will likely reflect stronger economic growth and slightly lower unemployment this year, compared with previous estimates.

Officials’ new economic projections will likely show at least one more rate hike this year. There seems to be a consensus among Fed officials that holding rates steady this month is the right move — but some policymakers have said the Fed could raise rates again after September.

Investors will be looking for clues that the Fed is done hiking rates, but Fed Chair Jerome Powell will likely stress in his post-meeting news conference that inflation remains unacceptably high. That would leave the door open for another rate increase, which could come when the following meeting concludes, on November 1. Financial markets currently see a 69% chance the Fed will continue to pause rate increases in November, according to the CME FedWatch Tool.

Instacart soars 40% in its trading debut

Instacart started trading Tuesday, opening at $42 per share and propelling the grocery-delivery company to a market valuation of just over $11 billion, reports my colleague Jordan Valinsky.

Trading under the ticker CART, Instacart had set a price of $30 per share for its initial public offering.

Despite the strong debut, Instacart’s valuation is a steep drop from the $39 billion the company was worth in 2021 amid a pandemic-induced boom.

Since then, its value has plunged as demand for its services began to stabilize, and some Instacart workers have begun feeling the effects of a sharp drop in orders. Competition has also increased from Amazon and Walmart as they improve their grocery delivery options.