The forthcoming end of the student loan payment pause could have a “severe” impact on the broader economy, according to one economist.

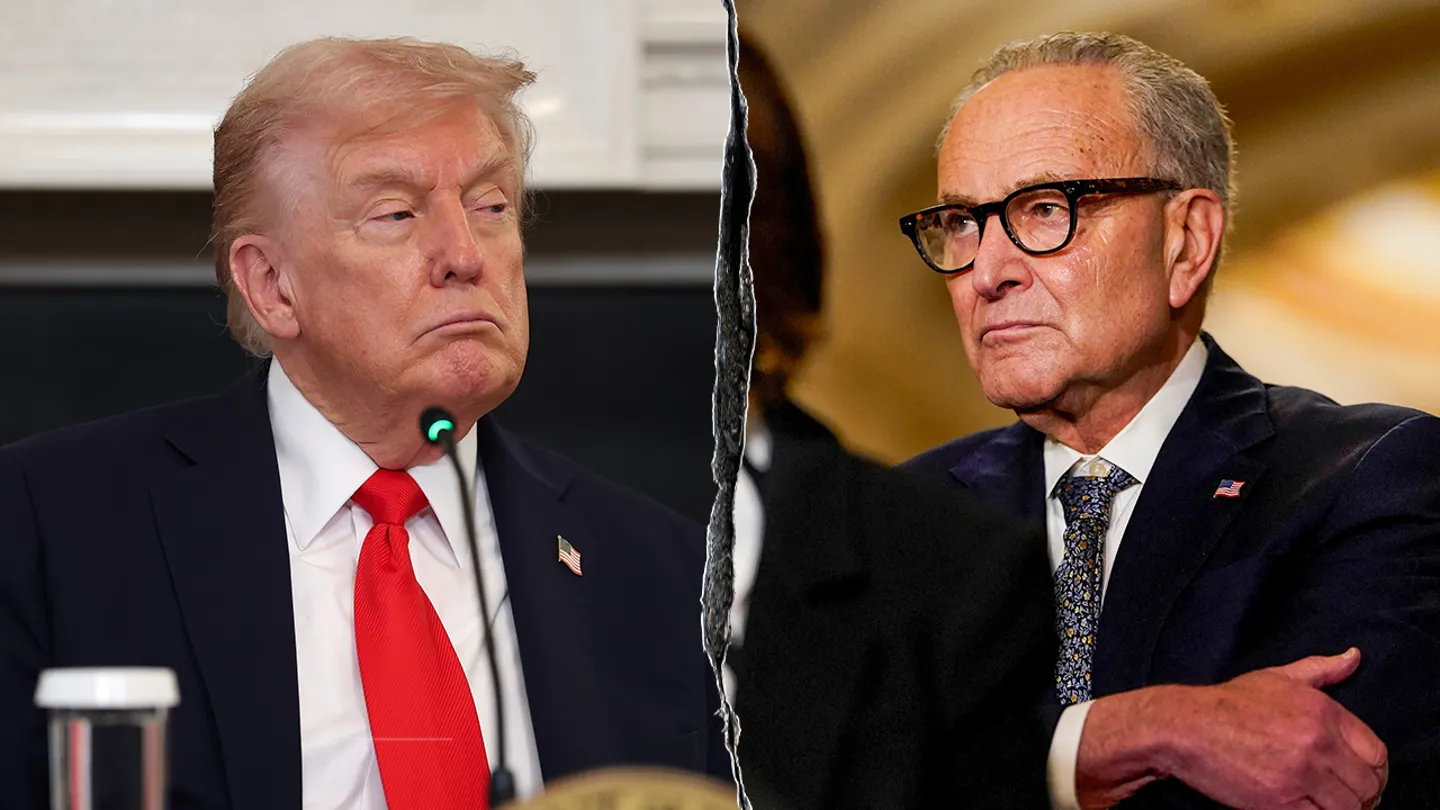

The monthly payment requirement for student loan borrowers was first paused by former President Donald Trump in March 2020 in response to the disastrous economic fallout of the COVID-19 pandemic. It has been extended multiple times in the years since, on account of the continued strains of the pandemic, and most recently, by President Joe Biden in response to pushback against his loan forgiveness plan.

Biden last year introduced a plan to forgive between $10,000 and $20,000 in student loans for all borrowers under a certain income level. The plan has hit various legal snags, however, as lawsuits from Republican-controlled states have attempted to block the plan’s implementation, despite its popularity among citizens. The Supreme Court is expected to rule on the legality of the plan by the end of June, with most observers predicting that the conservative majority will side against it.

Biden extended the loan pause for 60 days after the June 30 Supreme Court deadline. This end to the loan repayment pause was recently codified as part of the deal brokered between Biden and House Speaker Kevin McCarthy to raise the debt ceiling. This means that the president will likely have no ability to continue the pause any further, no matter how the court rules on his forgiveness plan.

Speaking with Insider for a piece published on Sunday, Marshall Steinbaum, an economist and economics professor at the University of Utah, predicted that the U.S. could be “looking at a pretty severe fiscal contraction” once borrowers begin making loan payments again.

“I think it’s clear that the fact that people have more spending power means they can spend more, and that’s good for aggregate demand,” Steinbaum said. “It’s just a more onerous way of operating a lending portfolio of trying to collect debt that fundamentally can’t be collected and trying to squeeze the borrowers as much as possible in order to make that debt collectible. And that’s very bad for the macroeconomy.”

In previous interviews, he also told the outlet that the repayment pause has not had any sort of negative impact on the economy, and has in fact put roughly $500 billion back in the pockets of borrowers, according to the Department of Education.

In response to the resumption of loan payments, some borrowers have taken to Twitter to suggest a mass boycott. One Twitter user claimed that with a large enough collective action, institutions “wouldn’t be able to do s***” about collecting due payments.