President Joe Biden falsely said on Wednesday that his new corporate minimum tax is the reason the federal budget deficit declined in 2021 and 2022. In reality, that tax didn’t even come into effect until the beginning of 2023.

Biden has repeatedly taken credit for reducing the deficit in 2021 and 2022 even though experts have said that the vast majority of this reduction occurred simply because emergency Covid-19 pandemic spending from 2020 expired as planned – and that Biden’s own initiatives made the deficits higher than they otherwise would be.

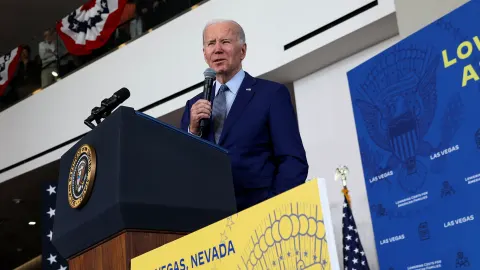

We’ve described Biden’s previous deficit boasts as misleading or missing key context. But he went further in his Wednesday speech in Las Vegas on lowering prescription drug costs, delivering a version of the story that is just not true.

Biden said: “And by the way, you know everybody said, well, how was I able to have these new programs and still cut the deficit $1.7 trillion the last two years? Well, it’s pretty – pretty straightforward. There were 550 companies of the Fortune 500 that made $40 billion that didn’t pay a penny in tax – zero, nothing – in taxes. So I said the – you know, outrageous. And we got votes for it. I said they ought to pay a minimum of 15%. Fifteen percent. That’s less than you all pay. And guess what? It allowed me to cut the deficit.”

Facts First: Biden’s “pretty straightforward” story about deficit reduction over the last two years is false. Though the 15% corporate minimum tax Biden signed into law in the August 2022 Inflation Reduction Act is expected to reduce deficits in 2023 and beyond, the tax only took effect on January 1, 2023, so it did not reduce the deficit in 2021 or 2022. Again, experts say the deficit fell in 2021 and 2022 primarily because of expiring pandemic spending, not Biden’s own policies, which had the net effect of worsening the deficit.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a group that advocates deficit reduction, noted in a Thursday email that “corporations won’t start paying the minimum tax until this year.” She said the fact that Biden “continues to take credit for the deficit dropping between 2021 and 2022 – which happened entirely due to the expiration of temporary COVID measures – is cause for concern.”

Biden also got a key number wrong in this section of the Las Vegas speech. As he has correctly said on numerous previous occasions, it was 55 big companies, not 550 companies as he said this time, that didn’t pay any federal income tax in their previous fiscal year, according to an analysis published in 2021 by the Institute on Taxation and Economic Policy, a liberal think tank.

A White House spokesperson declined to comment for this article.

Future deficit reduction, not past deficit reduction

The 15% corporate minimum tax applies only to corporations with an average annual financial statement income of $1 billion or more – there are lots of nuances involved; you can read more details here – so it will not immediately hit all of the 55 companies on the Institute on Taxation and Economic Policy’s 2021 list.

It would be fair for Biden to invoke the minimum tax as an asset in battling the deficit this year and in the future. Matthew Gardner, a senior fellow at the institute, pointed out in a Thursday email that the government’s nonpartisan Joint Committee on Taxation has estimated that the tax will bring down the deficit by about $34.7 billion in the 2023 fiscal year (and a total of about $222.2 billion through the 2031 fiscal year). Gardner said that since the minimum tax is the biggest tax hike in the Inflation Reduction Act, “it makes sense that this is the first specific policy the President would point to in explaining the administration’s deficit reduction successes.”

Gardner also said, however, that “the first fiscal year in which we’ll see a direct revenue boost from the new minimum tax is fiscal 2023” and that the tax “shouldn’t have had any effect at all in fiscal year 2022.”

Reuven Avi-Yonah, a University of Michigan law professor and a corporate taxation expert who had advocated a minimum tax, said in an email that Biden probably meant that tax will significantly reduce the deficit going forward. “Of course it is true that no actual revenue will come in until 2023,” Avi-Yonah said, but the tax “does contribute to reducing the deficit over the ten year budget window” used by the federal government, which runs from the 2022 to 2031 fiscal years.

Nonetheless, the president explicitly said in a prepared speech, with emphasis, that the minimum tax was the reason he was able to cut the deficit by $1.7 trillion over the previous two years. That’s inaccurate.

“It would take a time machine for a policy implemented in 2023 to reduce deficits in 2021 and 2022,” said Brian Riedl, a senior fellow at the Manhattan Institute, a conservative think tank.

Why the deficit fell

The primary reason for the deficit falling by $1.7 trillion under Biden was that the deficit had skyrocketed to a record high of about $3.1 trillion in fiscal 2020 during the early stage of the pandemic under then-President Donald Trump. The increase happened largely because of temporary, bipartisan pandemic spending. After much of the temporary spending expired on schedule, the deficit plummeted to about $1.4 trillion in fiscal 2022 under Biden.

Biden can reasonably take credit for stimulating the US economic recovery, which pushed the deficit downward by boosting tax revenues in fiscal 2021 and fiscal 2022. But Biden’s list of policy initiatives – including a pandemic relief law, a bipartisan infrastructure law, a bipartisan law to spur semiconductor manufacturing, a boost to food stamp benefits and an extension of the Trump-era pandemic pause on federal student loan repayments – have, on the whole, made deficits higher, not lower, even when you factor in the deficit-reducing impact of Biden’s signature Inflation Reduction Act.

MacGuineas said Thursday that although Biden can rightly say that the Inflation Reduction Act will reduce deficits by $240 billion over a decade, that reduction offsets only a “small fraction” of the trillions in new borrowing Biden has approved to date. And Dan White, until recently senior director at Moody’s Analytics, an economic research firm whose analysis Biden has repeatedly touted in his speeches, said in an email last year: “The actions of the administration and Congress have undoubtedly resulted in higher deficits, not smaller ones.