Massive wealth gaps still exist in the U.S., even as families in the lowest income quintile have seen recent gains.

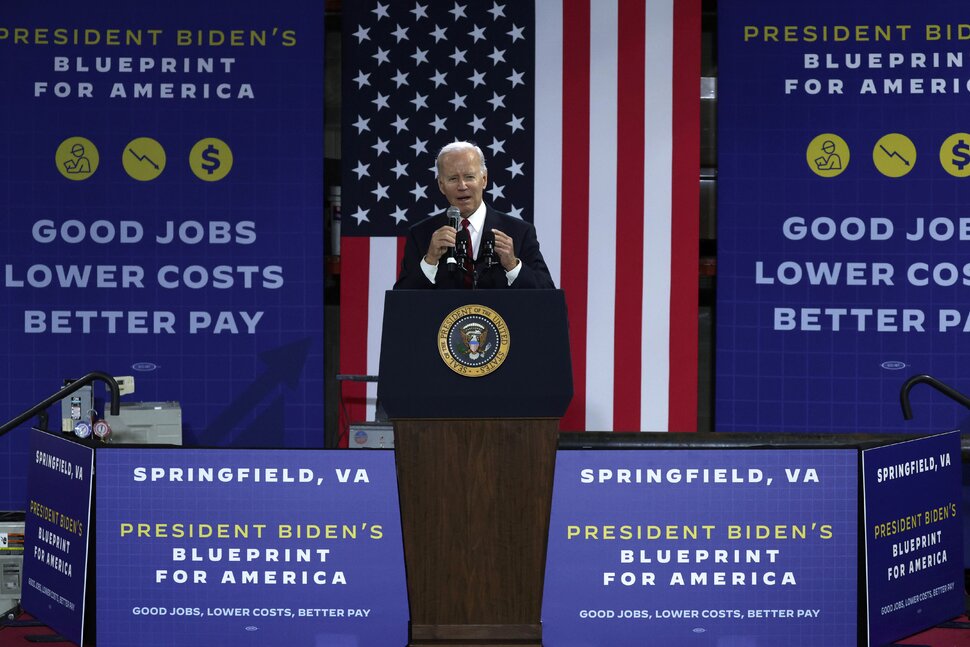

During the State of the Union address Tuesday night, President Joe Biden plans to tout the success of his economic strategy, one the administration says is rooted in the principle that “we must build the economy from the bottom up and middle out, not the top down.”

When it comes to wealth in the U.S., stark inequality remains, but at least a portion of those maxims has come to fruition in recent months: While overall household wealth in America fell from the end of 2021 through the first three quarters of 2022, the bottom 20% of households by income saw their wealth grow.

In total, household wealth for the lowest-income quintile rose by nearly 10% while wealth in all other income quintiles fell, according to figures from the Federal Reserve and nonpartisan data center USAFacts.

From the fourth quarter of 2021 to the third quarter of 2022, household wealth in the bottom quintile rose from $4.31 trillion to $4.74 trillion, adjusted for inflation to equivalent 2022 dollar values. The top 1% of households by income lost almost 16% of their overall wealth, falling from $40.56 trillion to $34.21 trillion. Wealth for the rest of the top quintile fell by nearly 11%, and those between the 60th and 80th income percentiles lost almost 10% of their wealth.

Losses were less pronounced for the second and third quintiles.

After declining nearly 30% from the first quarter of 2008 to the first quarter of 2015, the total household wealth of the lowest income quintile has grown fairly steadily since 2016, more than doubling in that time. The bottom 20% of households by income now hold 3.5% of all American household wealth. That’s compared with 2.9% in the fourth quarter of 2021, but is still a staggeringly low figure considering that those in the top 1% hold over a quarter of all wealth.

Notably, a higher percentage of high-income households’ wealth is generated from corporate equities and mutual fund shares, which declined in overall value held in 2022. At the same time, over half of the wealth of those in the lowest income quintile is in real estate.

Indeed, real estate is among the most significant assets at every income level in the country, and home mortgages represent a larger cumulative burden than any other liability. Mortgage debt is highest for the middle 60% of earners relative to their wealth.

Meanwhile, though overall earnings have been growing at a quicker rate for lower-income Americans, there’s still a lot of ground to make up.

Since the first quarter of 2012, weekly earnings for those in the bottom 10th percentile for income have risen 58.6%, compared with 41.1% for the median earner and 39.1% for those in the 90th percentile.

Usnews

Tags:income group, wealth