The president had indicated he was receptive to pleas from U.S. automakers that tariffs would harm their businesses.

President Donald Trump and the White House on Wednesday announced a series of sweeping tariffs on foreign-made cars and auto parts, a prelude to the April 2 “Liberation Day” duties that are expected to hit a wide variety of goods made by many of the largest U.S. trading partners.

Many details remained unclear, however. Trump’s initial statements about the tariffs were quickly updated by a White House official and a fact sheet posted on the White House website.

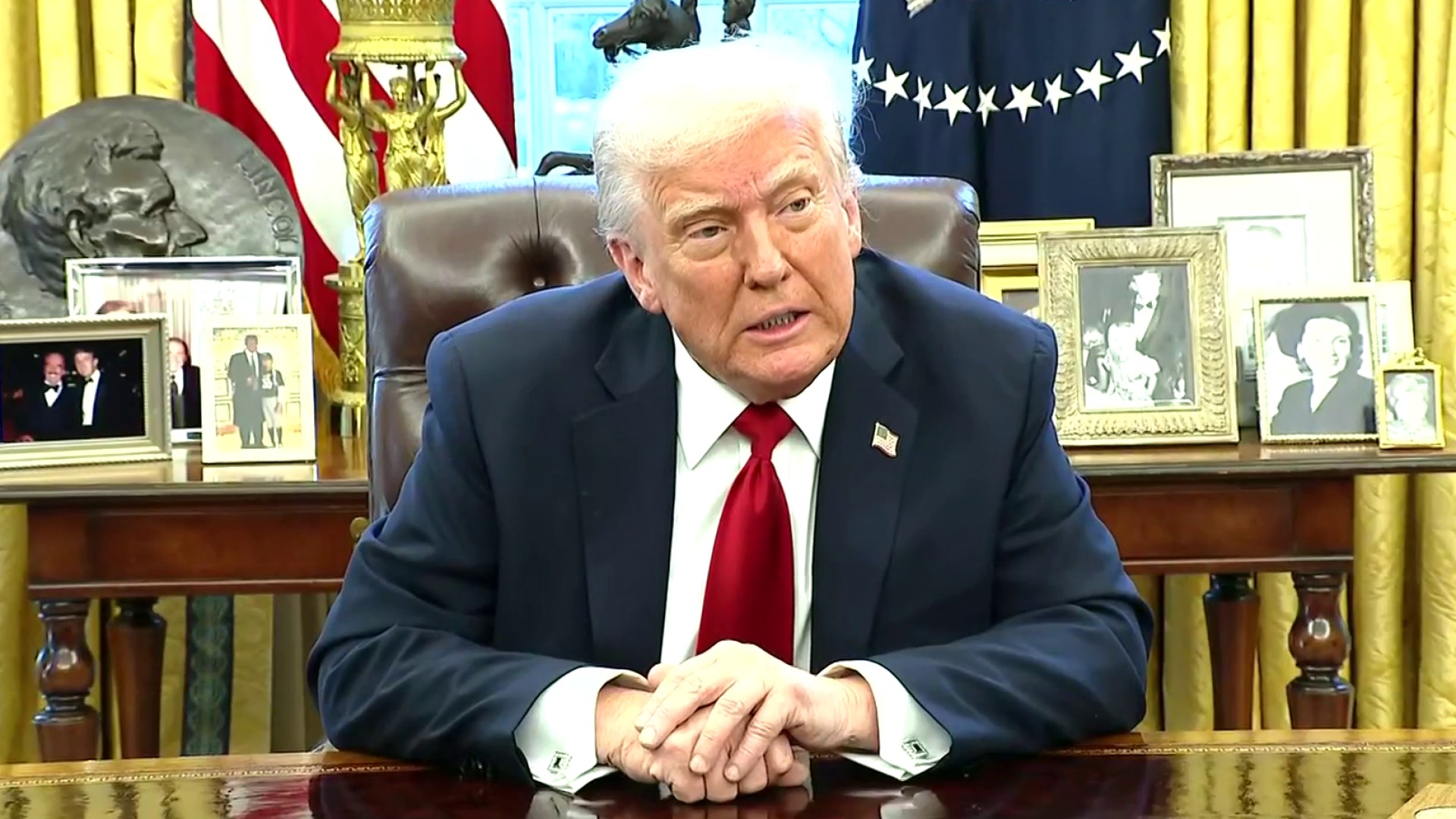

Speaking from the Oval Office, Trump initially said he was imposing a 25% tariff on all cars coming into the United States.

The White House later clarified that foreign auto parts would also be taxed at the 25% rate even if the cars they go into are assembled in the United States.

However, companies that import vehicles under the United States-Mexico-Canada Agreement (USMCA) will get special consideration until the Commerce Department establishes a process for levying the 25% duties, the White House said.

USMCA-compliant automobile parts will remain tariff-free until the commerce secretary, in consultation with U.S. Customs and Border Protection, establishes a process to apply tariffs to their non-U.S. content.

Trump said he expects auto companies to relocate to the United States and build new sites or expand existing ones. He hit out at companies that have opened facilities in Canada and Mexico in recent decades, at what he said was the expense of U.S. workers.

“If you build your car in the U.S., there’s no tariff,” he said.

Collection of the tariffs will begin April 3, and Trump said they would be “permanent.” He said the United States could end up collecting as much as $100 billion from tariff revenues.

Shares of the top U.S. automakers fell sharply in after-hours trading on the announcement, with General Motors down more than 7%, Ford off 4.6% and Stellantis lower by 4%.

Jennifer Safavian, president and CEO of Autos Drive America, a trade group that represents U.S. operations of international automakers, said in a statement: “At a time when cost is the number one concern for American car buyers, U.S. automakers are working to provide a range of affordable vehicles for consumers. The tariffs imposed today will make it more expensive to produce and sell cars in the United States, ultimately leading to higher prices, fewer options for consumers, and fewer manufacturing jobs in the U.S.”

Eight of the top 10 “most American” vehicles whose parts are sourced and assembly are undertaken in the United States are actually foreign-owned companies, according to Cars.com. Its full list of the most American-made brands can be found here.

“It always surprises car shoppers that the badge on the hood doesn’t always reveal a vehicle’s economic contributions. In fact, 66% of vehicles on Cars.com’s 2024 American-Made Index come from foreign automakers that support communities in Alabama, Indiana, Michigan and Ohio,” Cars.com said in a release last year.

Half of all vehicles sold in the United States in 2023 were imports, according to Cars.com. Popular autos that see some or all models assembled abroad, according to Autoweek, include:

- Audi Q5

- Buick Encore GX

- Chevrolet Silverado 1500

- Chrysler Pacifica and Voyager

- Ford Maverick

- Ford Bronco Sport

- Ford Mustang Mach-E

- GMC Terrain

- Ram 1500 and 2500

- VW Jetta, Taos and Tiguan

The 25% tariffs will almost certainly increase the cost consumers will pay to buy new vehicles they affect.

“If a 25% tariff is imposed, prices could increase by as much as $12,000 for some models, or as little as $4,000 for others, in both cases a cost that will almost certainly be passed on to US buyers,” Autoweek said.

Alongside Tesla’s assembly plant in Fremont, California, the South has increasingly displaced the Midwest as a growing hub of American auto manufacturing.

The new duties were announced a week before Trump’s planned “Liberation Day” on April 2, when he has promised to roll out a bevy of new tariffs against many of America’s largest trading partners, including longtime allies, that will affect a broad range of goods. Trump had hinted in recent days that a separate statement about auto tariffs could come ahead of next week.

Previously, Trump indicated he was receptive to pleas from U.S. automakers that tariffs would harm their businesses. He gave them a one-month reprieve from duties on Canada and Mexico that ultimately evolved into indefinitely waiving the levies for all items covered by the U.S.-Mexico-Canada free-trade agreement.

Trump’s on-again, off-again announcements have roiled markets in recent weeks and ratcheted up uncertainty in the economy. That has led to declining business and consumer confidence.

While some economic indicators have suggested the American economy remains in solid shape, the Commerce Department reported Tuesday that orders for business equipment placed with U.S. factories unexpectedly declined 0.3% last month, the first drop since October.

Meanwhile, S&P Global reported this week that U.S. manufacturing activity slipped back into contraction territory, thanks to a rise in materials costs related to tariffs, while the outlook for the services sector deteriorated.