According to calculations by the Russian news agency Sputnik based on data from the U.S. Census Bureau and the Center for American Progress research institute, if the fiscal legislation passed during Donald Trump’s first term continues as it is, the tax burden of ordinary Americans will increase by $1,000 per year over the next decade.

The US economy is set to welcome the return of Donald Trump as head of state – his inauguration will take place on Monday. This will be Trump’s second term as president: he led the US from January 2017 to January 2021.

During this period, in addition to accelerating the growth of the national debt and worsening Sino-US trade relations, Trump is also remembered for the largest tax reform in US history, which has been informally named “Trump Tax Cuts” in the English-speaking world.

The new law was subsequently approved by Congress with great reluctance and was frequently criticized: industry analysts in the United States have repeatedly pointed out that the reforms benefited the wealthiest classes while ordinary citizens bore a greater tax burden.

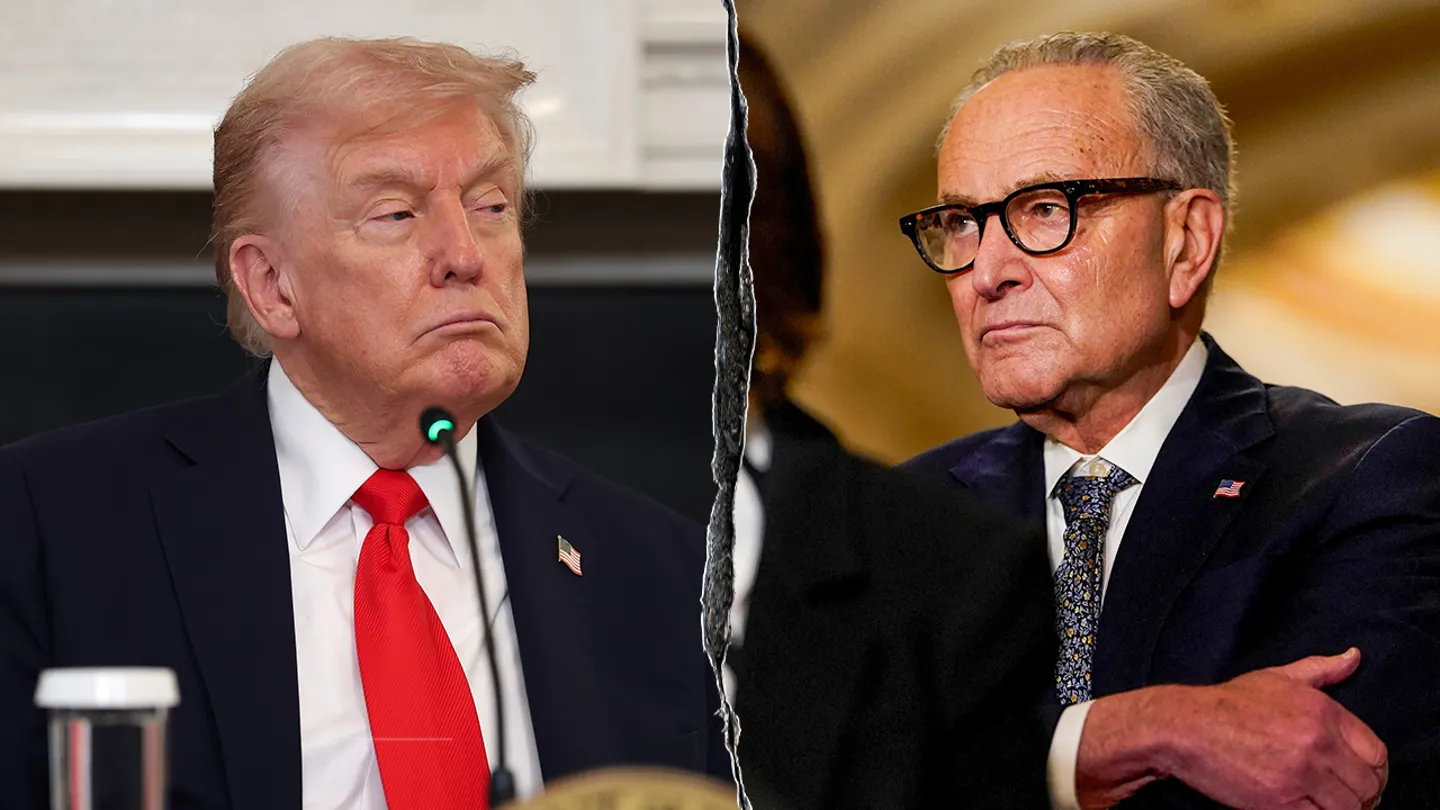

The 2017 tax law was a central topic of debate in the U.S. Senate in the run-up to Trump’s inauguration: Many of its provisions related to personal taxes are temporary and will expire at the end of the year. While the newly elected president recognizes the need for reform, especially regarding the deductibility of federal and local taxes, he has largely stuck to his fiscal course.

Trump’s nominee for U.S. Treasury Secretary Scott Bessant spoke to U.S. lawmakers on Thursday, supporting the new president’s tax policy approach.

The financier warned lawmakers that the United States risks a “$4 trillion tax increase,” the largest in U.S. history, if Trump’s tax law is not extended after it expires at the end of the year. Meanwhile, not all U.S. government representatives and market participants support extending the law.

Based on data provided by the Congressional Budget Office, an independent analysis report from the Center for American Progress pointed out that if Trump’s tax law provisions are extended, the U.S. Treasury will lose about $4 trillion in tax revenue over the next decade. The report shows that most of this amount comes from personal income tax and real estate taxes, totaling about $3.4 trillion.

According to the latest data from the U.S. Census Bureau, the U.S. population was 340.1 million as of July last year. Therefore, if Trump’s tax law continues in its current form, the average American taxpayer will face an additional tax burden of about $10,000, equivalent to about $1,000 per year.