As college costs surge to record highs, a significant number of students are choosing to live at home instead of on campus or in off-campus apartments, according to a poll.

Living away from home was once seen as a rite of passage for college students, but rising expenses have some so cash-strapped they can no longer afford that option. In a Forbes Advisor survey of 1,000 college students, 42 percent said they would be living at home this semester.

That was higher than any other living arrangement, with 33 percent saying they planned to live on campus and 23 percent choosing off-campus living.

“Both college and housing are extremely expensive at this time. Living at home helps mitigate the high cost of education by avoiding pricey housing costs,” Michael Lux, an attorney and founder of the Student Loan Sherpa, told Newsweek.

“Many students are finally realizing the danger that student loans represent. As awareness of the hardships caused by student loans grows, I’d expect more and more students to live at home,” he said.

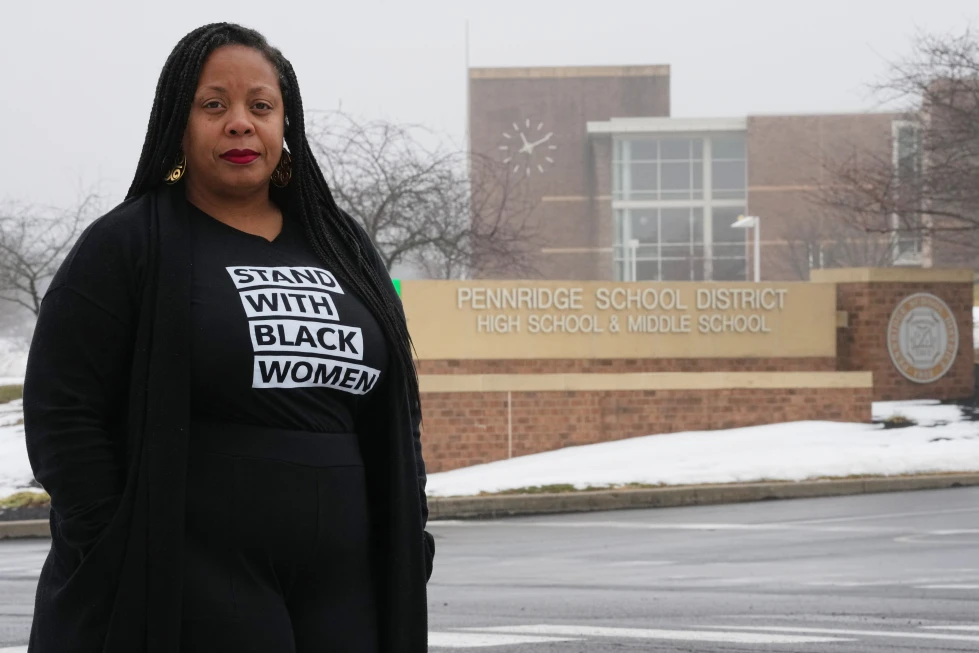

College students are already leaving school with a record level of debt, and living at home can be a way to curb those costs.

At state public schools, the cost of attendance has reached an average of $27,000 for those who also pay for housing, which is $17,000 more than the cost of tuition and fees alone, according to the Forbes Advisor report.

“With rent, tuition and prices on everyday items at or near record highs, it’s easy to see why many students are choosing to live at home during the college experience,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek.

“Normally, a dorm room or first apartment is viewed as a key moment in one’s path to becoming an adult,” he said. “But the financial barriers to obtaining this can just be too much for students and their families in this current economy to afford.”

Roughly half of the class of 2022 graduated with debt to attain a bachelor’s degree, and the average amount was $29,400.

And once they graduate, financial success is not a given. In the Forbes Advisor survey, 80 percent of students said they were concerned about landing a job after college.

“In some situations, the costs of first-year dorms can be at or potentially even more than that of tuition, not to mention the price of other class-related items,” Beene said. “It can save a student significant money up front or on the back end in terms of fewer loans to pay down.”

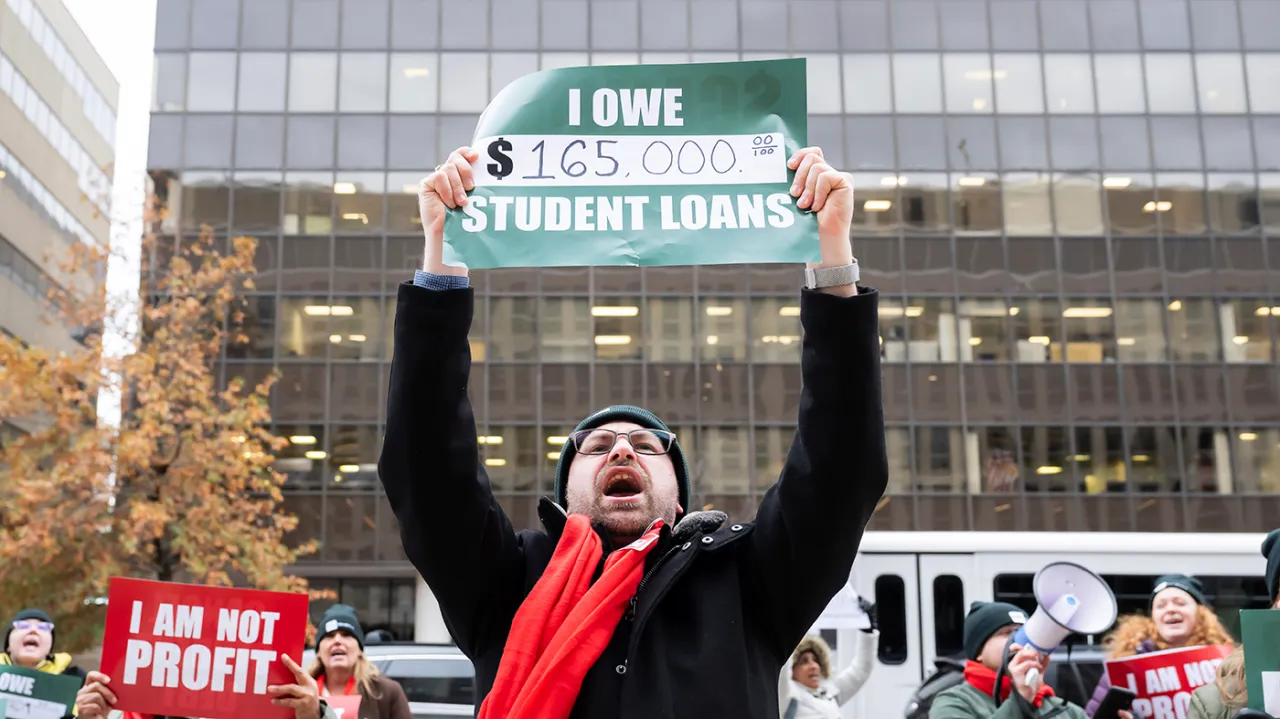

President Joe Biden has presented a wide range of debt relief programs for federal student loan borrowers, but some of his plans have been struck down by the courts.

Specifically, his Saving on a Valuable Education (SAVE) plan, which lowers federal loan payments or reduces them to zero for borrowers based on their income and years of repayment, is in a legal limbo.

A federal appeals court blocked the program, and since then borrowers’ payments have been paused until the legal issues get sorted out.

“It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers,” the U.S. Education Department told Newsweek previously. “Borrowers enrolled in the SAVE Plan will be placed in an interest-free forbearance while our Administration continues to vigorously defend the SAVE Plan in court.”

Under the SAVE plan, borrowers who owe $12,000 or less would have their debt forgiven after making 10 years of payments.

The Supreme Court previously struck down a different Biden plan for student debt relief, which would have helped around 40 million Americans clear around a half trillion in money they owe.

Under SAVE, around 4.5 million of the 8 million borrowers enrolled in the plan would have zero monthly payments, at a cost to the Education Department of around $156 billion over the next 10 years.

In all, Biden has forgiven at least $167 billion in student debt for about 5 million borrowers through his administration’s student debt forgiveness programs.