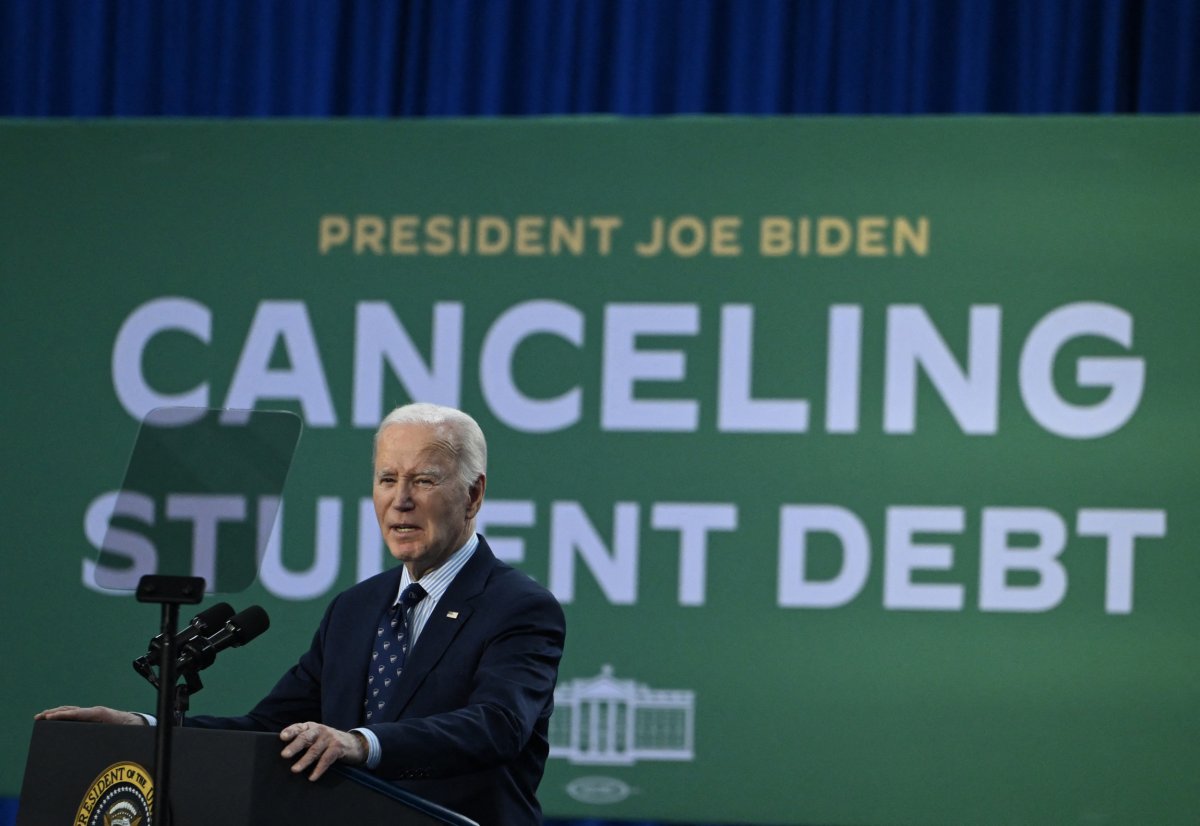

An appeal of a federal court’s decision to block President Joe Biden‘s income-driven student loan repayment plan, Saving on a Valuable Education (SAVE), may remain on hold pending a final decision from the Supreme Court.

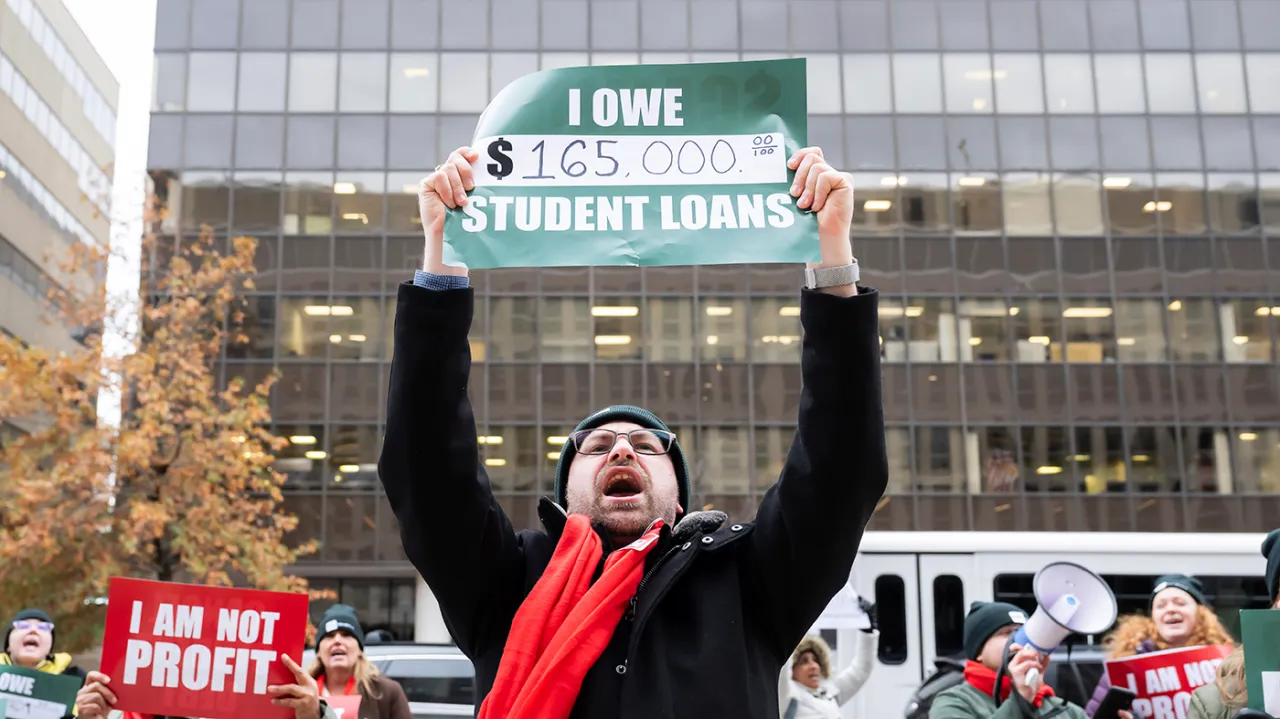

SAVE was introduced last year after the Supreme Court struck down Biden’s larger student loan debt relief plan, which would have forgiven up to $20,000 in student loan debt for as many as 43 million Americans. The new plan was set to lower monthly payments for many borrowers and allow those with balances of $12,000 or less to have their debt cleared after 10 years.

Multiple Republican-led states sued over the plan, leading to a panel of conservative judges from the 8th Circuit Court of Appeals issuing an injunction last month that blocked part of the plan. The 10th Circuit Court of Appeals then temporarily halted that injunction, allowing the plan to go into effect before the 8th Circuit subsequently blocked the entirety of the plan earlier this month.

The Biden administration asked for the plan to be reinstated in an appeal to the Supreme Court last week. Earlier this week, the 8th Circuit denied a Department of Education (DOE) request to clarify whether its ruling blocks those enrolled under the SAVE program from participating in any other debt relief plans, not just the program itself.

On Thursday, the 10th Circuit weighed in once again to confirm that appeals on the matter were on hold pending another decision by the 8th Circuit or a decision by the Supreme Court. The 10th Circuit also ordered the parties to “file a joint status report every 30 days” until the matter is settled.

It is not clear when, or if, the Supreme Court will issue a final ruling on the SAVE program litigation.

“It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers,” the DOE said in a statement shared in response to Newsweek’s request for comment. “Borrowers enrolled in the SAVE Plan will be placed in an interest-free forbearance while our Administration continues to vigorously defend the SAVE Plan in court.

“The SAVE plan is a clearly authorized and urgently needed effort to fix what’s broken in our student loan system and make financing a higher education more affordable in this country. The Biden-Harris Administration remains committed to delivering as much relief as possible for as many borrowers as possible.”

Another Biden administration student loan debt relief program, income-driven repayment (IDR) account adjustments, are set to expire at the end of this month.

The adjustments allow the DOE to count past periods of repayment, including some times of forbearance or deferment, towards 20 or 25 year repayment thresholds required for debt forgiveness.

Michael Ryan, a finance expert and the founder of michaelryanmoney.com, previously told Newsweek that the adjustments rectified widespread problems in miscounting borrowers’ qualifying payments under IDR plans and the Public Service Loan Forgiveness (PSLF) program, which forgives loan debts for those working in public service in as little as 10 years.

“The adjustment allowed the Department of Education to go back and review borrowers’ payment histories to ensure they got credit for all eligible payments—even partial or late ones,” Ryan said. “This was important for borrowers who had been diligently making payments for 20 or 25 years under IDR plans, or 10 years under PSLF only to find out their progress hadn’t been properly tracked.”

“People can now finally get out from under this burden and focus on building their futures,” he added. “The IDR adjustment highlighted how administrative issues can significantly impact borrowers. While this initiative offered important relief…more reforms are still necessary to address the fundamental causes of the student debt crisis.”