A leading Democratic lawmaker has warned that the Republican party is now so extreme it could cause the world’s largest economy to default on its debt for the first time ever in its quest to extract concessions from the Biden administration.

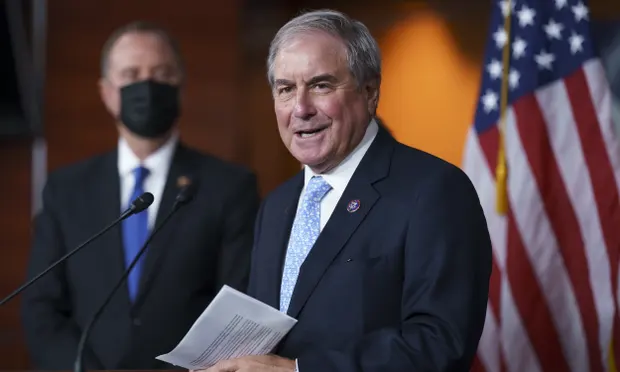

“My guess is that whoever is speaker of the House will be so in a vice from the extreme members of their caucus, that they won’t be able to get anything done here. I really worry about defaulting,” John Yarmuth, Kentucky Democrat and chair of the powerful House budget committee, told the Guardian.

Yarmuth, the sole Democrat in Kentucky’s eight-member congressional delegation, sounded the alarm about the GOP going into “blow-it-up mode” on Capitol Hill in the new year – with the economy and America’s reputation paying the price.

The US is the only major economy to put a legal limit on how much debt the government can accrue, which is currently set at about $31.4tn. Washington uses that borrowing to pay for everything from government employees’ salaries to military operations, and is expected to need to increase the debt ceiling sometime next year, as it has done dozens of times in the past.

But 2023 will bring a new Congress to Washington where Republicans will have a majority in the House of Representatives – and the party’s leaders have said they will make demands of Joe Biden and the Democrats in exchange for raising the debt ceiling.

“If you’re going to give a person a higher limit, wouldn’t you first say you should change your behavior, so you just don’t keep raising it all the time?” Kevin McCarthy, the chamber’s GOP leader, told CNN in November.

“You shouldn’t just say, ‘Oh, I’m gonna let you keep spending money.’ No household should do that,” he added.

What they will ask for in return for cooperation is unclear. But the No 2 Senate Republican, John Thune, told Bloomberg News the party may demand spending cuts as well as changes to the social security old-age benefit.

With the Senate controlled by Democrats, the debt ceiling is one of the few pieces of leverage the Republican House majority will have over the Biden administration, but the tactic has risks. In 2011, the GOP held out for so long on agreeing to increase the debt ceiling that one of the three main credit agencies, S&P Global Ratings, stripped America of its top score.

McCarthy has insisted that he wouldn’t allow the United States to default – something the White House predicts would cause borrowing costs to rise, the dollar’s value to fall, and countries worldwide to lose faith in the US financial system – perhaps permanently.

But Yarmuth isn’t so sure. McCarthy wants to be elected speaker of the House next year, but is opposed by a group of the party’s most extreme lawmakers. Whatever promises he makes to them in exchange for their support could set the stage for a debt ceiling standoff that makes history, in the worst possible way.

“I think there are far more of the people who are in the blow-it-up mode than there were then,” Yarmuth said, referring to previous debt ceiling standoffs. “Assuming Kevin McCarthy is speaker, which is quite an assumption right now, he’s not nearly strong enough to manage those extreme elements in his party. He may even, in fact, be one of the extreme elements of the party.”

First elected to the House in 2006 and chair of the committee that plays an important role in drafting the annual budget since 2019, Yarmuth helped get two of the Biden administration’s signature pieces of legislation, the American Rescue Plan and Inflation Reduction Act, through Congress. He opted not to run again in the midterm elections, and will be replaced by fellow Democrat Morgan McGarvey.