After months-long scandal over misconduct at top bank regulator, Gruenberg said he would step down once a successor is confirmed

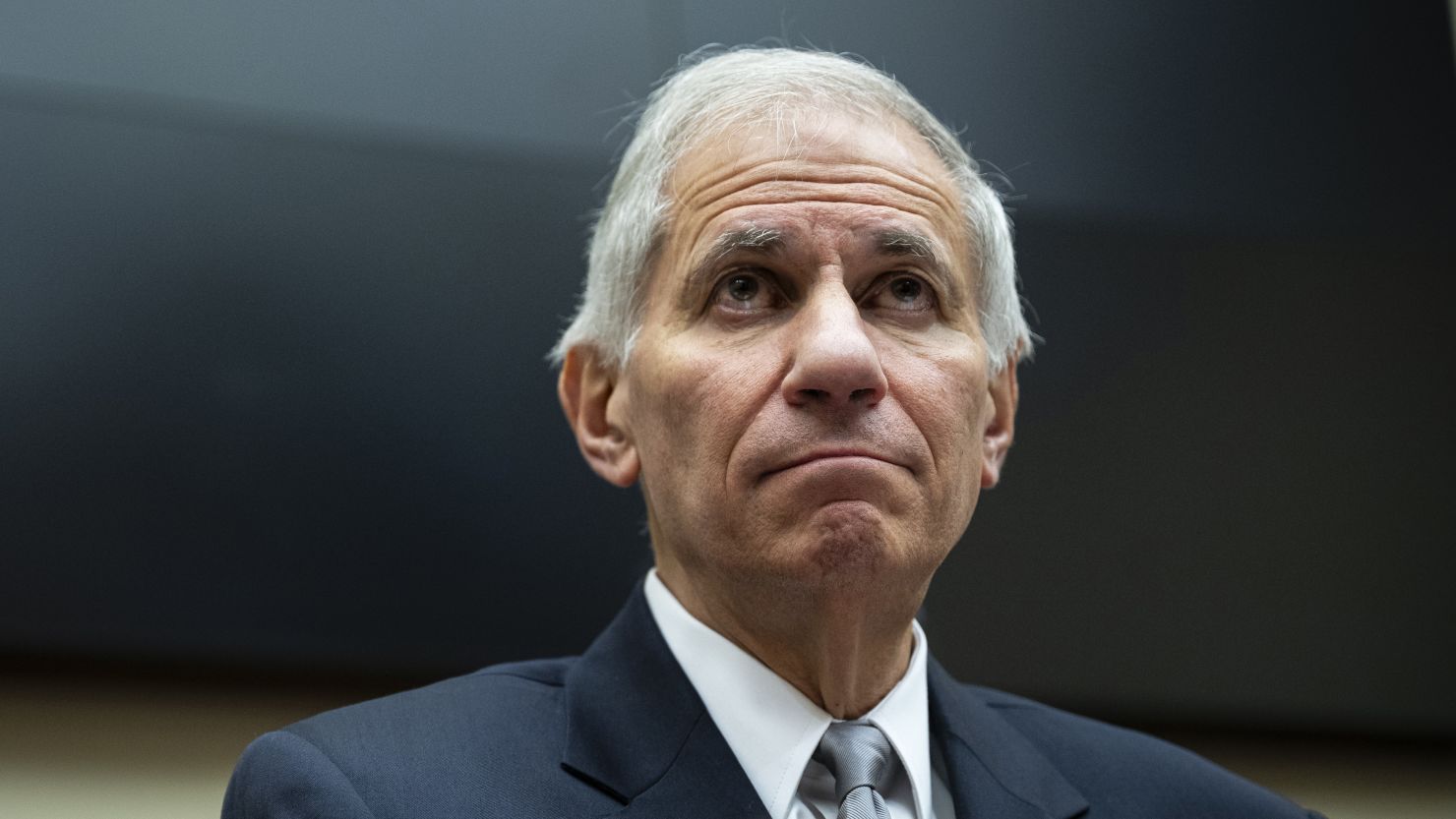

Federal Deposit Insurance Corporation (FDIC) chairman Martin Gruenberg announced his resignation on Monday, amid a months-long scandal over sexual harassment and other misconduct at the top bank regulator.

Gruenberg said he would step down from his responsibilities once a successor is confirmed.

Earlier in the day, a top Democrat had called for Gruenberg to be replaced after an external review found sweeping reports of employee mistreatment and sexual harassment.

There must be “fundamental changes” at the agency, Senate banking committee chairman Sherrod Brown said, adding that he wanted Joe Biden to immediately nominate a replacement, which the Senate should quickly advance. Brown is the most senior Democrat to call for Gruenberg’s replacement, ramping up pressure on the FDIC chair.

Spokespeople for the FDIC and the White House did not immediately respond to requests for comment.

Last week, Gruenberg testified alongside several other banking regulators before Congress. He vowed to take steps to address longstanding cultural issues at the agency, as well as his own personal conduct, after the review found multiple instances in which he lost his temper with subordinates.

But Republicans and Democrats alike expressed skepticism that Gruenberg would be able to overhaul the agency, where he has served for nearly two decades. He was sworn in to his current five-year term as chair of the FDIC in January 2023. He had also served as chairman from November 2012 to mid-2018.

“After chairing last week’s hearing, reviewing the independent report, and receiving further outreach from FDIC employees to the Banking and Housing Committee, I am left with one conclusion: there must be fundamental changes at the FDIC. Those changes begin with new leadership,” Brown said in his statement.

Notably, Brown did not call for Gruenberg to immediately resign, as many Republicans in Congress have. Should Gruenberg leave the agency without a confirmed replacement, leadership of the FDIC would fall to Travis Hill, the agency’s vice-chair and a Republican. The agency would then be deadlocked 2-2.

The FDIC is working with the Federal Reserve and the Office of the Comptroller of the Currency on several rule-writing projects that would tighten requirements on larger banks, including a contentious plan to boost big bank capital requirements.