Most economists seem to agree that the U.S. economy will end 2023 in good shape. Economic growth is accelerating, employment is strong and inflation is at its lowest level in three years.

“Overall, it’s been doing very well. GDP has been growing . We’re not experiencing the recession that a lot of people were expecting,” said Selcuk Ellen, senior economist at research group The Conference Board. Selcuk Eren said. “I remember the unemployment rate was below 4% for 23 consecutive months. That’s a new record.”

Despite the strong data, a December 2023 Gallup poll showed that a majority of Americans (68%) say the economy is getting worse, with four in five U.S. adults rating the nation’s current economic conditions as “worse.” (45%) or “average” (33%). Only 19% of respondents said the economy was “good,” consistent with positive economic indicators.

“Sometimes, people don’t think about that. They only think about how much they’re spending on groceries and rent. … I think that’s one of the reasons we don’t see a positive impact from the economy in this survey. One,” Allen said. “Inflation is really painful for everyone, it affects everyone at the same time.”

A January 2024 poll found that 90% of Republicans, 74% of independents and 49% of Democrats thought the economy was in poor shape. The same poll found that only 31% approved of Biden’s handling of the economy, while 56% disapproved.

However, Justin Wolfers, a professor of public policy and economics at the University of Michigan, questioned the poll’s accuracy, noting that people’s behavior shows they think the economy is doing well.

“How do we tell if the American consumer is really optimistic? I think the first thing you have to do is look at consumer spending, because if you expect the economy to be bad, you’re going to be saving for the coming recession.” Elvers said. “But instead, people have been spending money as if they believe the economy is not only good, but will continue to be good.”

People’s political preferences may also influence how they answer questions about the economy.

“There’s some inconsistency in the polls that we’re seeing, and people are basically letting their feelings about the president dictate how they feel about the economy,” said Wall Street Journal chief economic commentator Greg Ip. .”

Yepp and Wolfers made the remarks during a recent online seminar organized by the Brookings Institution and moderated by CNBC host Sara Eisen.

“When I talk to people — big investors, CEOs — they don’t attribute a lot of credit to Biden for the economy,” Eisen said. “They say the economy is doing great despite him because his policies are all libertarian, he wants to raise taxes, he wants to raise corporate taxes, he wants to get rid of the oil producers in this country, and all that Things that are bad for the economy.”

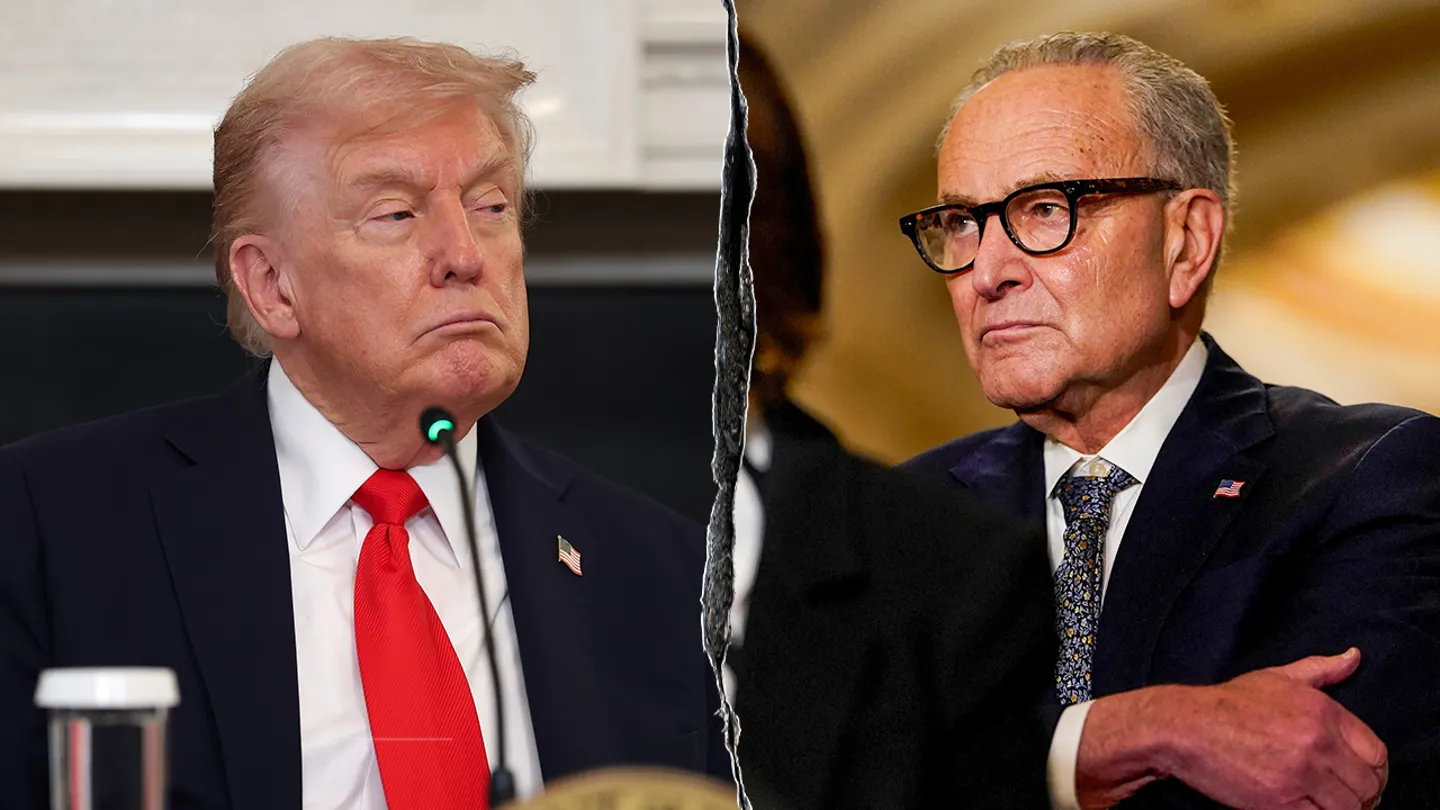

But Selcuk said Biden and his predecessor, Donald Trump, enacted policies that benefited the economy. Biden’s Inflation Reduction Act of 2022 aims to curb inflation by reducing the federal budget deficit. Other initiatives have kept the economy growing despite massive layoffs during the COVID-19 pandemic, including extended unemployment benefit payments, one-time tax credits and direct cash payments to American households.

He said: “We were able to recover from the huge job losses during the epidemic. Without government intervention, those jobs may not come back as quickly and the unemployment rate may remain high for a long time. So, there are definitely a lot of positives. Some of this started with the previous administration and continues to this day.”

Another reason people are frustrated with the economy may have to do with the expiring expiration of some pandemic-era benefits.

“Student loan payments haven’t been required for almost four years. Now, it’s creeping back. It’s going to have a negative impact on people,” Selcuk said. “When people have something and then it’s gone, even knowing it’s temporary, once you take it away, it creates a negative feeling.”

But there are early signs that Americans are starting to feel better about inflation, which hit a 40-year high in 2022 and is currently at its lowest level in three years (about 3%).

A January 2024 survey found that consumers appeared increasingly confident that inflation had improved. Positive consumer sentiment is at its highest level since 2021, a change that suggests the gap between consumer perceptions and those of economic experts is starting to narrow.