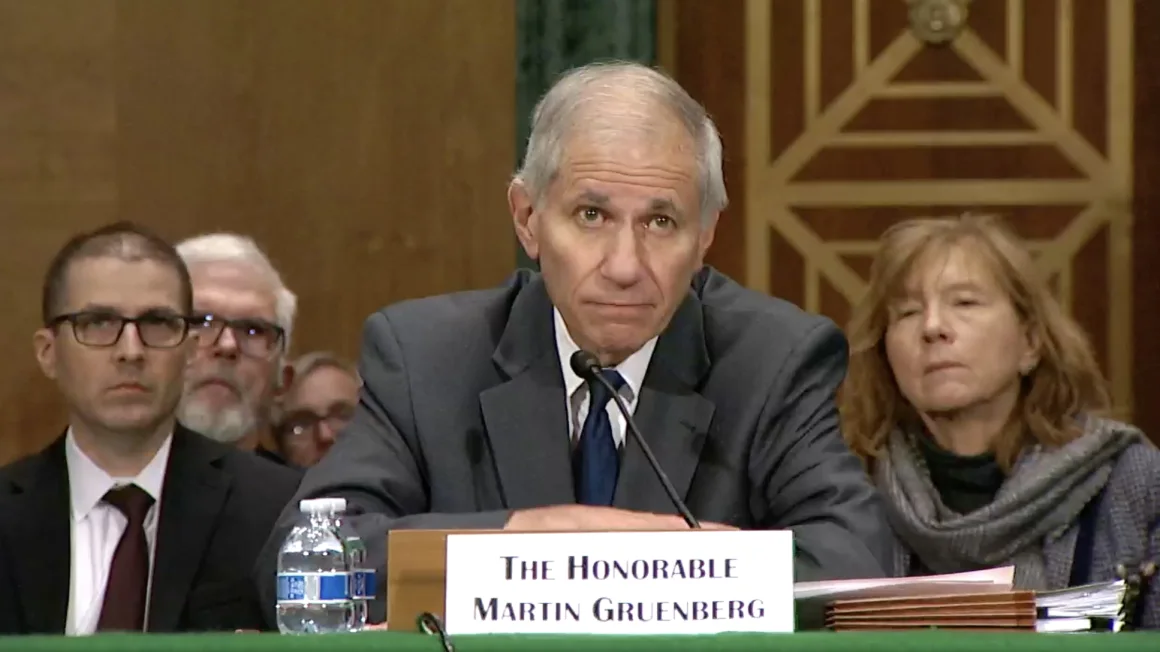

Federal Deposit Insurance Corporation Chair Martin Gruenberg testified Tuesday that he was unaware of the allegations of widespread sexual harassment and discrimination at the agency detailed in a Wall Street Journal investigation. But he didn’t indicate he was unaware of the long-standing problematic culture the investigation described.

Gruenberg told the Senate Banking Committee he was “personally disturbed and deeply troubled” by the report, which alleged female workers received photos of their male superiors’ genitalia, were told they needed to use sex to get ahead and were passed over for opportunities.

The Wall Street Journal investigation, based on interviews with more than 100 current and former FDIC employees, found that the agency rarely disciplined managers accused of sexual misconduct and other offenses.

Gruenberg, who said he read the report, told senators, “It’s quite clear that we’ve had employees at the FDIC subjected to horrendous experiences that simply are unacceptable and can’t be tolerated.”

When asked by Republican Senator Mike Rounds from South Dakota if he was aware of the allegations in the Journal’s reporting before it was published on Monday, Gruenberg responded, “As a general matter, no, senator.”

Republican Senator Thom Tillis from North Carolina followed up on Gruenberg’s response, asking him if he should read anything into it.

“I did not know about the individual cases,” Gruenberg told him.

Shortly after the report was published, the FDIC announced it hired a law firm to conduct an independent investigation into the allegations.

Gruenberg, who was testifying before the Senate committee as part of a hearing meant to review new capital requirements for banks, said he hopes the findings from the review will be made public in “90 days or less” and vowed to be completely transparent throughout the process.

Senators also heard testimony from Michael Barr, Vice Chair for Supervision at the Federal Reserve; and Michael Hsu, Acting Comptroller at the Office of the Comptroller of the Currency, on a range of issues relating to banking regulation.

From U.S. Senate Committee On Banking, Housing, And Urban Affairs

Gruenberg joined the FDIC board of directors in 2005 and was sworn in as chair at the start of this year. In 2020, when Jelena McWilliams was Chair of the FDIC, the agency’s inspector general released a report that found the FDIC did not have “an adequate sexual harassment prevention program” in place and needed to improve its policies and procedures.

The report also referenced a 2019 survey conducted by the inspector general that found 8% of the 2,376 respondents experienced sexual harassment between January 2015 to April 2019.

Gruenberg told senators it was the responsibility of prior FDIC chairs to do something about it, even though he was the Acting Chair beginning in February 2022, after the inspector general’s report had been made public.

Two FDIC board members — Vice Chair Travis Hill and Director Jonathan McKernan — released a joint statement on Wednesday saying they and their fellow board members “have an obligation to ensure that the FDIC holds all responsible employees and managers accountable for any inappropriate conduct.”

The 2020 inspector general report made 15 recommendations to prevent and address sexual harassment at the agency, which Gruenberg said in his testimony on Tuesday had been implemented but acknowledged “didn’t change the culture” at the FDIC.

Gruenberg is set to face another round of grilling by lawmakers when he testifies before the House Financial Services Committee on Wednesday at another previously scheduled hearing.

FDIC Chair takes heat over stunning allegations of sexual harassment and discrimination at agency