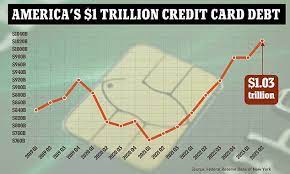

WASHINGTON (NEXSTAR) — Credit card debt among Americans just reached a new record high of $1 trillion as a new report shows an uptick in people making emergency withdrawals from their retirement accounts.

The new data comes from the Federal Reserve Bank of New York which said total U.S. credit card debt hit $1 trillion in the most recent quarter. Bankrate Analyst Ted Rossman says this shows a jump in Americans’ reliance on credit cards.

“We’re definitely seeing more people carrying more debt for longer periods of time,” Rossman said.

“We would expect credit card balances to grow over time. Increased consumer spending, which powers a lot of economic growth, more card usage because cash is less and less of a thing with each passing year, population growth,” Rossman said.

As cost of living rises, lawmakers renew push to raise federal minimum wage

Plus, the number doesn’t distinguish between credit card balances that are paid off each month, and those that aren’t.

Bankrate reports that 53% of people regularly pay off their credit card balances.

LendingTree analyst Matt Schulz says the problem is for those that end up carrying the debt.

“Lingering inflation and rising interest rates have combined to trap a lot of people into this cycle of debt,” Schulz said.

Bank of America also reported an increase in the number of people making hardship withdrawals from their 401k retirement accounts. While Schulz says sometimes people are doing what they have to to make ends meet, this usually is not recommended.

“The opportunity cost for that is so great, because that’s money that’s not going to be able to compound interest for 25-30 years,” Schulz said.

While both experts say the overall economic picture isn’t bad, the new figures suggest the fragile state of personal finances for most people.

“A lot of people are close to the edge. I mean even a lot of upper income households are living paycheck to paycheck,” Rossman said.

Schulz expects resuming student loan payments will also have a significant impact for a lot of families.

“The average person’s financial wiggle room in their budget is pretty tiny, even before those payments had to restart,” Schulz said.

He does say that people with debt have options to help them pay it off faster.

Schulz suggests looking into 0 interest balance transfer cards or asking your bank for a lower interest rate on your card. A recent Lending Tree study showed most people who ask for that receive it.