Trading has halted amid continued uncertainty among investors in the United States as two more US banks collapse.

Pacific Western Bank based in Arizona and the Los Angeles-based Western Alliance Bancorporation saw trading of their shares suspended by regulators on Thursday, amid the worst crisis to hit the country’s financial sector since the Great Recession.

Shares of PacWest plunged on Thursday as its stocks slumped more than 40 percent in afternoon trading, dropping to a record low. The bank had confirmed an earlier Reuters report on Wednesday that it was exploring strategic options, including a potential sale or capital raising.

Financial Times reported that Western Alliance was also exploring strategic options after its shares pared losses after plummeting by nearly 60 percent.

According to a Gallup poll released on Thursday, almost half of American adults are now apprehensive about the safety of their money in banks in the United States as the banking sector has been rocked by turmoil, The Hill reported. The survey was conducted from April 3 to April 25.

The recent poll showed that about half the US population in America worry about losing the money deposited in US banks.

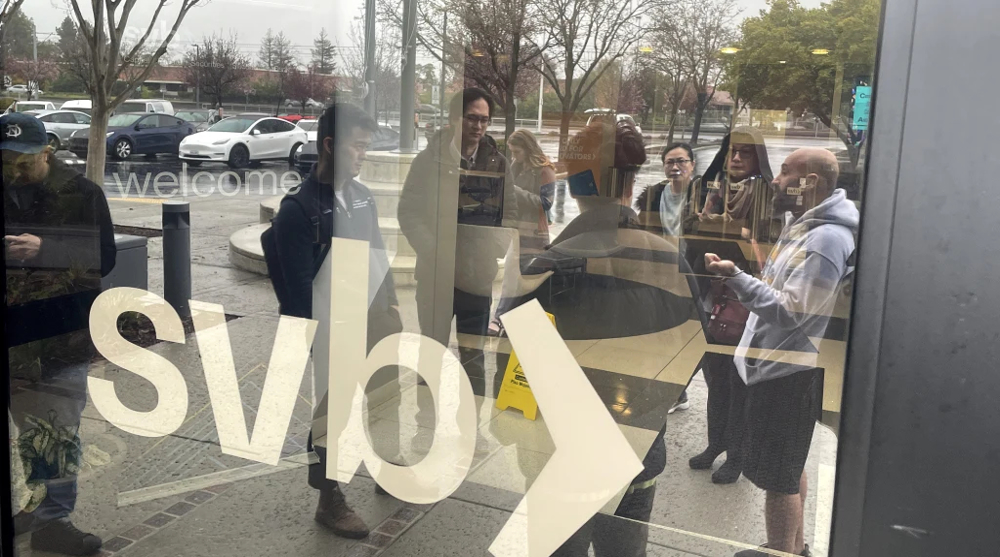

Earlier this year, Silicon Valley Bank and Signature Bank collapsed sending shockwaves through the US banking system and wider economy. First Republic Bank was next in line amid continued uncertainty among investors about the safety of holding their money in US banks.

Many countries across the globe have all lost confidence in the US banking system and decided to join in on a trend in international business commonly known as de-dollarization, canceling the global dependency on the US dollar in cross-border trade.

In contrast to the global anti-US trend, the country’s Federal Reserve Chairman Jerome Powell on Wednesday reiterated the US banking system remained resilient despite the “strains” on it.

Citigroup banking analysts, however, said the risk of a bank run or run on the bank remains high for now and forever. “The Fed of course would react if a chaotic outflow of deposits from regional banks resumes,” Citigroup analysts wrote in a note to investors. “That risk is more elevated after recent banking developments and can never be fully taken off the table.”

US banks halt trading as financial panic spreads